Disposed of property recently? pay your cgt on time!

The rules around ‘gains’ on the disposal of UK property have changed significantly.

READ MORE

Company director responsibilities – don’t go rogue!

New government legislation is set out to better deal with "rogue" directors.

READ MORE

Are you employing staff in 2021? ensure that you understand the rules post brexit!

New rules impact potential employees of UK businesses that are citizens from the EU.

READ MORE

Taking payments with paypal – simplify the accounting!

Many businesses take payments via PayPal for a variety of reasons, make it easier with Quickbooks or Xero

READ MORE

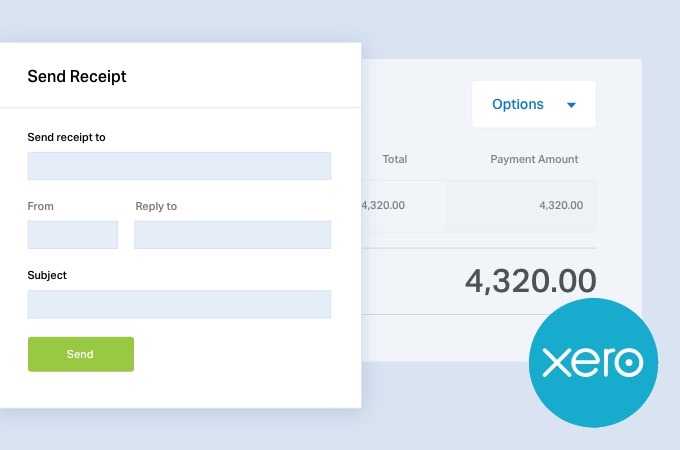

Getting more from xero – using ‘remittances’ for suppliers

The value of using ‘Remittances’ in Xero accountancy software.

READ MORE

Coronavirus (covid-19) – seiss 5th (and final) grant !

HMRC have now confirmed that the ‘Fifth’ Grant under the SEISS scheme will shortly be open for further claims

READ MORE

Coronavirus job retention (‘furlough’) scheme (cjrs) – final scheme changes!

Government supported scheme is now expected to be closed at the end of September 2021

READ MORE

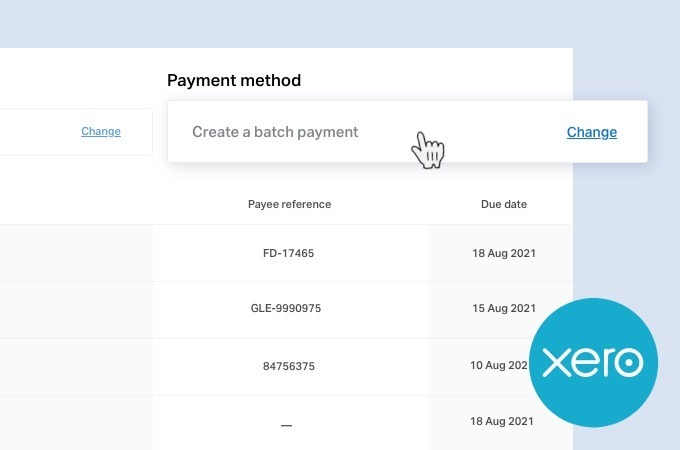

Getting more from xero… using ‘batch payments’ i.e. (supplier payment runs)

We highlight the importance of ‘Batch Payments’ in Xero accountancy software

READ MORE