Hmrc and tax payments

How do you deal with HMRC in respect of tax liabilities?

READ MORE

Arrs: the additional roles reimbursement scheme.

The ARRS scheme aims to build the necessary additional roles within Primary Care in order to solve the workforce shortage within general practice and recruit 26,000 additional staff into the sector

READ MORE

Zettle: reduce accounting in retail & hospitality!

Continuing our series of highlighting the benefits of using business software that is ‘integrated’ (or ‘linked’) with Quickbooks or Xero

READ MORE

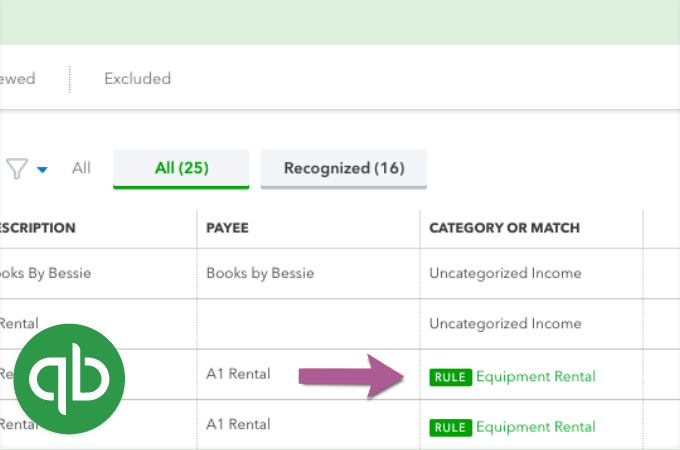

Getting more from quickbooks… bank rules!

We highlight the use of ‘Bank Rules’ in Quickbooks.

READ MORE

Digital ‘right to work’ checks

New immigration employment rules, came into force affecting citizens from the EU, Iceland, Liechtenstein, Norway and Switzerland (not Ireland though!)

READ MORE

Using ‘gocardless’ for customer payments

The powerful impact that GOCardless and the ‘automation’ of payments can have on YOUR cashflow

READ MORE

The ‘furlough’ scheme

Ensure your businesses didn't make any errors in their use of the scheme deal with any repayments

READ MORE

Thinking about ‘exiting’ or selling your business?

For Entrepreneurs and SME business owners more generally, a lot of hard work goes into creating a successful business over a long period of time.

READ MORE