Making tax digital for income tax

November 23, 2022

Although there has been a delay to the implementation of ‘Making Tax Digital’ (MTD) for Income tax and Self Assessment taxpayers – it is now planned.

- to start from 6th April 2023 for NEW sole trader/landlord taxpayers (with turnover over £10,000)

- as a requirement for ALL sole traders and landlords to sign up for MTD for Income tax from April 2024

Are you aware of how it may affect your sole trader business, OR your income as a landlord – see our summary of the changes below!

WHAT IS ‘MAKING TAX DIGITAL’ (MTD)?

The most significant development which has been driven by HMRC in recent years is the introduction of the ‘Making Tax Digital’ (MTD) programme, which to date relates only to VAT (see our previous Blogs on this topic) – with other business taxes e.g. Income tax and Corporation tax etc., moving onto the MTD platform very shortly!

- This MTD programme is a key part of the Government’s plan to move to a fully digital tax system, and at the same time is designed to help eliminate common errors for taxpayers.

- Although there has been a delay in the implementation of ‘Making Tax Digital’ (MTD) for Income tax and Self Assessment taxpayers – it is now planned

- To start from 6th April 2023 for NEW sole trader/landlord taxpayers (with turnover over £10,000)

- As a requirement for ALL sole traders and landlords to sign up for MTD for Income tax from April 2024

HOW WILL ‘MAKING TAX DIGITAL’ (MTD) FOR INCOME TAX WORK IN PRACTICE?

For the relevant Self Assessment taxpayers i.e. sole traders and landlords, the requirements of MTD include the following (and are broadly similar to those that VAT-registered businesses are now complying with):

1. To keep all of their income and expense records digitally

2. To use ‘MTD compatible’ software i.e. Xero and/or Quickbooks for all of their digital records

3. To submit ‘quarterly’ updates and end-of-period statements to HMRC (this is a VERY significant change for these taxpayers)

4. To submit a final declaration for each tax year

- The main issue for accountants as well as for taxpayers, is that their sole trader business or rental financial information will NOW BE REQUIRED to be updated accurately ahead of each quarter submission – similar to VAT-registered businesses!

- It will NO longer be possible to just wait until AFTER the 6th of April each year to start preparing the accounts and other figures for inclusion in the Self Assessment tax return!

- Given that it requires businesses to move away from Excel and/or any manual accounting system, to a system based on the use of Xero and/or Quickbooks etc. for their ‘day to day’ bookkeeping, this is precisely what we would advise clients to do in any case

OTHER ISSUES FOR MAKING TAX DIGITAL (MTD) FOR INCOME TAX

1. The ‘Quarterly updates’

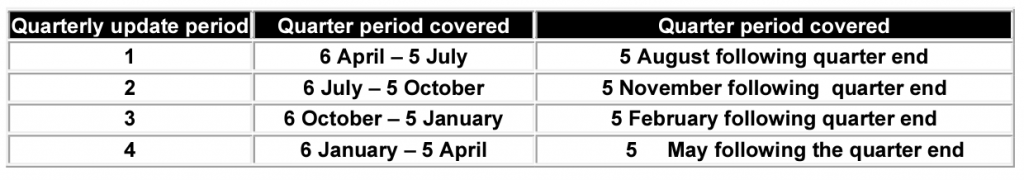

The basic requirement under ‘Making Tax Digital’ (MTD) for Income tax, is that an update is provided to HMRC each quarter as follows – however different calendar quarters can be used by a taxpayer with the agreement of HMRC!

2. The ‘End of Period Statements’

Each taxpayer must also provide an ‘End of period Statement’ for each income source e.g. rental income, which includes ‘end of period’ information e.g. accounting adjustments, any reliefs claimed etc as well as a ‘Declaration’ that the information in the statement is correct and complete.

The ‘End of the period statement’ will be required to be submitted to HMRC by 31st January after the end of each tax year.

3. The ‘Final declaration’

The ‘Final declaration’ will replace the existing Self Assessment tax return, and will enable the taxpayer to inform HMRC about any other personal income for that tax year, submit claims for reliefs or deductions etc. in the normal way (with an existing Self Assessment tax return)

Again the ‘Final declaration’ submission wil be required to be made to HMRC by 31st January after the end of the tax year.

NEXT STEPS

There will be exemptions for taxpayers that are below the income thresholds (currently £10,000 per annum), as well as some delays to moving to the MTD platform for growing businesses etc., but the main issue for sole traders and landlords – is to move to a digital platform, whether Xero or Quickbooks etc., NOW

– in preparation for, and

– to ease the eventual move onto MTD in the next 12/24 months when it becomes applicable to YOUR business!

Feel free to contact the Sakura Team if you want additional advice or support with MTD for VAT or to prepare ahead of time for MTD for Income tax.

Contact us on 0207 952 1230 or info@sakurabusiness.co.uk