Vat and the ‘reverse charge’ for construction – are you clear on the changes?

The VAT ‘Domestic Reverse Charge’ for Building and Construction Service businesses is a new VAT regime

READ MORE

Considering xero or quickbook? – see our comparison guide

We have narrowed the selection down to two specific software packages i.e. Xero and QuickBooks Online

READ MORE

Require additional covid related finance? – see the recovery loan scheme (rls)

The Government has recently launched a NEW finance initiative to support businesses in 2021

READ MORE

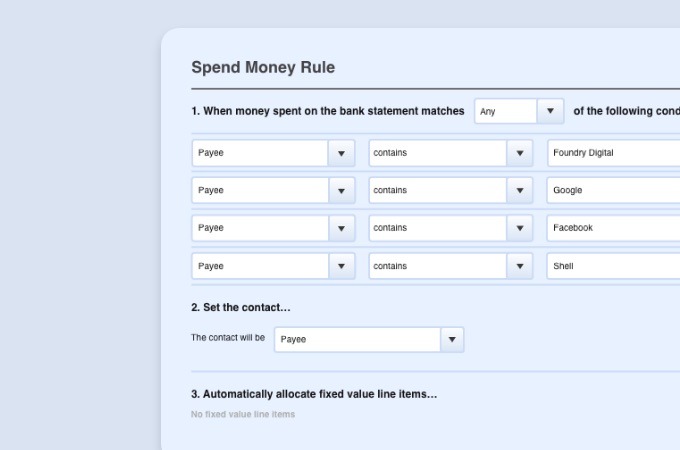

Getting more from… xero – using ‘bank rules’

Continuing our series of highlighting some really useful features in Quickbooks or Xero

READ MORE

Vat changes in 2021 – how does it affect your e-commerce business?

If you are an e-commerce business there is a BIG change occurring from 1st July 2021!

READ MORE

Covid-19 self employment income support scheme (seiss) – apply for the 4th grant now!

Extension of the SEISS scheme grants into mid 2021

READ MORE

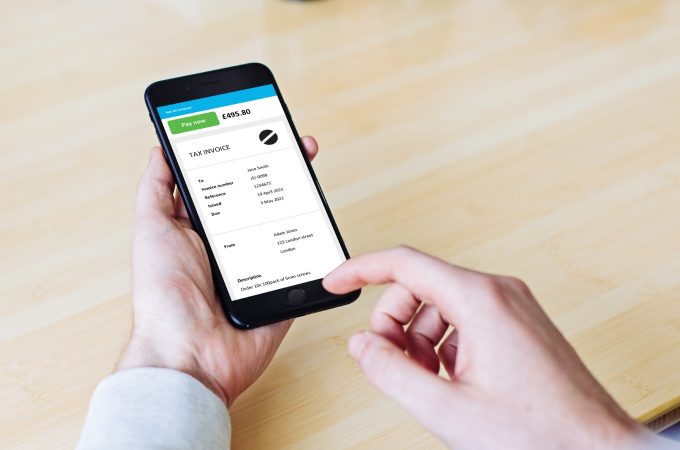

Getting more from xero – payment services

How the connection to Xero of third party payment providers like Stripe, PayPal and GoCardless can form a key part of your credit control processes within Xero

READ MORE

Working from home – is there some tax relief?

With the ‘normalisation’ of regular ‘Working from Home’ (WFH) arrangements in 2020 and 2021 for most Employers and employees, resulting from COVID-19 ‘lockdowns’...

READ MORE