Xero ‘add on’ software… using xero payroll

November 23, 2023

Continuing our series of highlighting some changes, developments and occasionally really useful features in Quickbooks or Xero, we now discuss the Xero Payroll ‘Add on’ software and whether it is a useful addition to the Xero ‘ecosystem’!

Find out more below!

What is Xero Payroll?

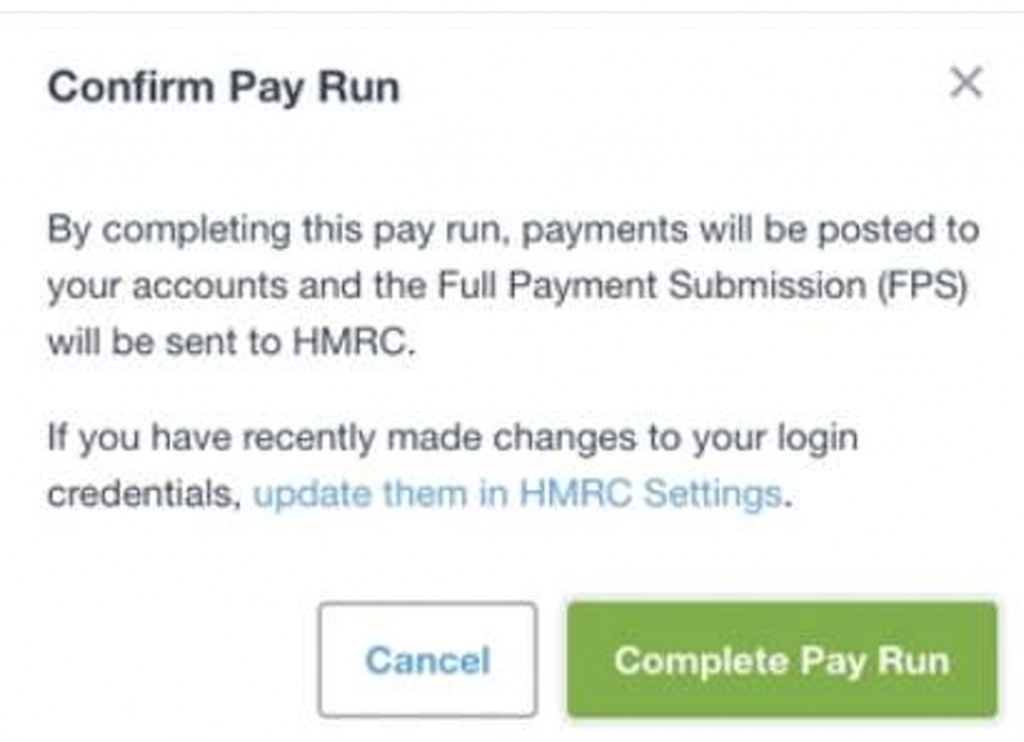

This is Xero’s payroll software, which is a straightforward ‘add-on’ to the core accountancy software. It enables payroll to be submitted directly online to HMRC, (as per other payroll software), while also automatically posting the monthly payroll journals into the accounts in Xero.

How do I use it?

It can simply be added into the accountancy software as an ‘add on’ enhancement to the core Xero software.

The payroll screens can be accessed directly from the main Xero software, with all of the standard payroll, pension and RTI submission processes available in the software – and also accessible from the mobile app as well.

Should I use this software in my business?

Our view of the software is that it is perfectly acceptable for small businesses with simple payroll requirements e.g. 2 directors and/or 2/3 staff with standard salaries, where there are larger numbers of employees AND complex payroll requirements e.g. variable salaries, bonuses, pension ‘opt-outs’ etc – then it is not ‘fit for purpose’ to simply and easily process monthly payroll!

Additionally, the Support is not sufficient to resolve the variety of queries that arise with those more complex payroll requirements.

How do I add the Payroll to the Xero software?

It just requires a simple update to the Subscription to add Xero Payroll to the core Xero accountancy software.

Is there any additional cost or is it included in my current subscription?

Yes – the ‘Add on’ software costs £5.00 per month for up to 5 employees

Can the Sakura Team assist with this?

No – on this occasion, we have made a decision that the software is not sufficiently robust and ‘fit for purpose’ for our Client’s requirements, so we do not work with this software at this time.

Obviously, if the Xero Payroll software is developed sufficiently that it meets our requirements then we will re-consider this decision.