How to read a profit and loss statement: a complete beginner’s guide

July 22, 2025

BACKGROUND

Again we are NOT saying don’t rely on your accountant, but we believe it is key for SME business owners to understand the basics of their Profit & Loss!

If you have some understanding of how to use your Xero or Quickbooks software, then it is important that you understand the basics of the Profit & Loss.

Understanding your business’s financial performance enables you to make theRIGHT decisions on your business, and the Profit and Loss (P&L) is a core part of any limited company’s accounts!

Below we will walk you through a few of the basics—no jargon, just clear, practical advice.

WHAT IS THE PROFIT & LOSS?

A Profit and Loss (also more recently known as an Income Statement) shows your business’s income and expenses over a specific period e.g. monthly, quarterly, or annually. Most importantly, it will tell you whether your business made a profit or a loss!

The Key Sections

The main sections in the Profit & Loss include the following:

1. Revenue (Sales)

This section can also be known as Billings, Income etc., but essentially shows all of the business earnings during the week, month or year from selling goods or services – before any costs are deducted.

2. Cost of Sales (COS)

These are all of the costs associated with the sales of your goods or services, therefore it is absolutely key that you identify all of the costs related to getting your goods or services sold to your customers.

Examples include costs of materials, staff, freelance staff, software, packaging etc.

The core formula for any business owner to understand is the following:

Revenue/Income/Billings – COS = Gross Profit

3. Operating Expenses (or Overheads)

These are the day-to-day running costs of your business, that are typically not associated directly with your sales, such as:

- Rent

- Light and heat

- Non sales staff Salaries

- Marketing

- Insurance costs

The other core formula for a business owner (and the most important one), is the

following:

Gross Profit – Operating Expenses (Overheads) = Net Profit (or in some cases

Net loss) Although there are some other expense like interest earned, loan interest or one-off

gains/losses, for simplicity these impact the overall Net Profits of the business.

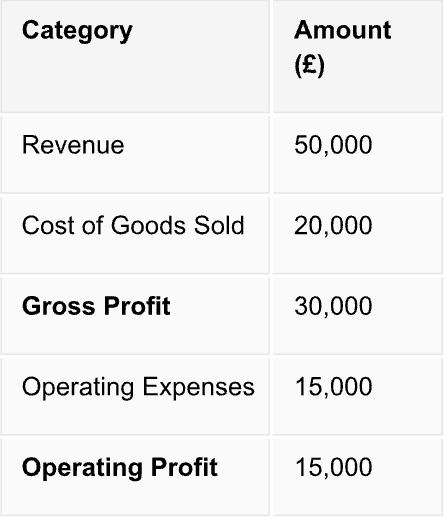

A very simplified Example

WHY A PROFIT & LOSS MATTERS

A Profit & Loss matters for the business owner because it clearly enables the appropriate decisions to be made on your company’s business performance

- HOW much is your company earning from your Customers each week, month, year?

- HOW much profit is the company making?

- ARE your business costs rising or rising faster than your income?

- Once you know what your income, costs and profits are, then you can make the RIGHT decisions on the business

- It forms the basis of the tax reporting for HMRC

A Profit & Loss is also is important for third parties as well (as is a Balance Sheet) for when lenders are considering providing third party finance, leasing any equipment or building relationships with suppliers etc.

FINAL THOUGHTS

Understanding and being able to read the key figures from your Profit and Loss doesn’t have to be intimidating or problematic

And once again – your accountant will actually appreciate the fact that you have a basic understanding of your key financial reports – as it will lead to better and more valuable discussions between you !

Do you want to understand some of your key figures and financial reports a bit better – to be able to make clearer and more informed decisions on your business ?

- GO to our website: to download our business guides or book a call

- SUBSCRIBE to our YouTube channel: for more information on this and other topics

- BOOK a call: directly with us