Have you submitted vat returns late?

December 2, 2021

BEWARE THE NEW HMRC PENALTY REGIME!

BACKGROUND

Last year a total of 519,120 VAT returns were filed late by businesses, which was an increase of 13% from the previous year – leaving many SMEs exposed to interest and penalties!

HMRC requires businesses to submit (or file) and pay their VAT for each quarter by the same deadline, which means that the majority of businesses that have submitted VAT returns late, are also likely to have paid late too.

The Government is changing and reforming the penalties for late submission and late payment of VAT returns to make them fairer and more consistent, with those changes expected to apply to businesses from 1st April 2022.

The new Late Payment Penalties regime will replace the current Default Surcharge, which is related to both late submission and late payment of VAT returns.

KEY POINTS AND COMPARISONS

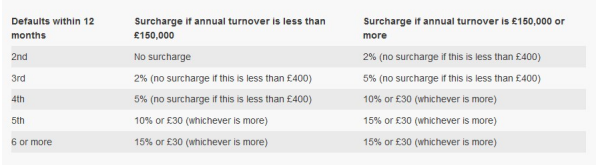

Under the existing ‘surcharge’ regime, where a business is late with the submission of a VAT return or a payment of the amount of VAT due, then the business is ‘in default’.

Currently this doesn’t give rise to any late penalties or interest from HMRC, however a ‘surcharge notice’ is issued to the business, which essentially specifies a 12 month period during which additional late VAT returns or VAT will generate penalties.

Further ‘defaults’ during the specific period will both extend the ‘surcharge period’, while also increasing the level of the ‘surcharge’ penalty on each subsequent ‘default’ i.e. up to an amount of 15%. At that point, the ‘surcharge period’ regime can only be exited through the submission and payment of 4 consecutive VAT returns!

Under the new scheme from 1st April 2022, there will just be two late payment penalties that may apply to a business e.g. a first penalty and then an additional or second penalty, with an annualised penalty rate.

– First Penalty

The business will not incur a penalty if the outstanding VAT is paid within the first 15 days after the due date.

However if the VAT remains unpaid after Day 15, the business incurs the first penalty i.e. an amount at 2% of the liability from Day 15 on the VAT return.

– Additional or Second Penalty

Where VAT continues to remain unpaid on the VAT return by Day 31, the business will begin to incur an additional penalty or Second Penalty on the VAT that remains outstanding. The penalties accrue on a daily basis, at a rate of 4% per annum on the outstanding amount.

This additional penalty will stop accruing once the VAT has been paid in full by the business.

HMRC will also charge interest on VAT that is outstanding after the due date, irrespective of whether any of the Late Payment Penalties (LPPs) have also been charged. Interest applies from the date the payment was due until the date on which it is received by HMRC at a rate of 2.5% + the Bank of England base rate.

VAT – OTHER ISSUES

- HMRC will offer taxpayers the option of requesting a ‘Time To Pay’ (TTP) arrangement. This enables a business to stop a penalty from accruing any further by agreeing an arrangement with HMRC to pay any outstanding VAT. It continues to apply, as long as the business continues to adhere to the terms of the arrangement.

- HMRC recognises that moving to the new system of late payment penalties is a significant change for some customers, especially those who might have more difficulty in getting in contact with HMRC within 15 days of missing a payment to begin arranging a Time-to-Pay agreement.

- HMRC will therefore take a light-touch approach to the initial 2% late payment penalty for customers in the first year of operation of the new system under both VAT and ITSA.

- Additionally, there is no penalty due if the taxpayer has a reasonable excuse for late payment. If HMRC is satisfied a taxpayer has a reasonable excuse HMRC will agree not to assess. This will prevent the taxpayer from unnecessarily having to appeal.

- A taxpayer will have the right to appeal against each late payment penalty that is assessed. They can challenge an assessment both through an internal HMRC review process and also by an appeal to the courts (the First Tier Tax Tribunal). The grounds for appeal may vary and include having a reasonable excuse for missing a filing deadline. The appeal process will be the same as the appeal process against an assessment of the tax on which the penalty is based.

Contact the Sakura Team if you are struggling with the submission or payment of your VAT returns, or if you need advice on avoiding VAT debts or avoiding surcharges. Contact us on 0207 952 1230 or info@sakurabusiness.co.uk

VAT – ILLUSTRATIVE EXAMPLES

– Example 1

The taxpayer owes £1,000, which they fail to pay on the due date. They approach HMRC asking for a TTP arrangement on Day 11 and they subsequently agree with HMRC a schedule to pay off the debt.

By approaching HMRC for a TTP arrangement, and subsequently agreeing one, the taxpayer enjoys the same benefit of paying their tax on Day 11. Their position is the same as it would be if they had paid their tax on Day 11; there will be no penalty. Late payment interest (LPI) will continue to accrue on any outstanding amounts.

– Example 2

Again, the taxpayer owes £1,000 and fails to pay by the due date. By Day 15 they have already incurred the first penalty at 2%: £20. They approach HMRC asking for a TTP arrangement on Day 20 and subsequently agree with HMRC a schedule for paying off their debt.

By agreeing a TTP arrangement, the taxpayer enjoys the same benefit of paying their tax on Day 20. Their position is the same as it would be if they had paid it on Day 20; the penalty is charged at 2%. LPI will continue to accrue on any outstanding amounts.

– Example 3

This time the taxpayer has failed to pay their tax by Day 30 and has already incurred the first penalty at 4%: £40. They have still not paid by Day 40 and have incurred 10-days’ worth of the additional or second penalty at 4% p.a. They approach HMRC on Day 40 and agree a schedule for paying off their debt.

By agreeing a TTP arrangement, the taxpayer enjoys the same benefit of paying their tax on Day 40. The second penalty stops accruing and they are only charged the additional penalty for Days 31 – 40. LPI will continue to accrue on any outstanding amounts.

RPI will be paid at the Bank of England base rate less than 1% (with a minimum rate of 0.5%).