Using ‘gocardless’ for customer payments

November 23, 2023

GETTING MORE FROM XERO & QUICKBOOKS . . .

Continuing our series of highlighting really useful (and time saving/stress reducing) features in Quickbooks or Xero, this month we are highlighting the powerful impact that GOCardless and the ‘automation’ of Customer payments can have on YOUR cashflow – and hence YOUR business!

Find out more below!

What does ‘GOCardless’ do?

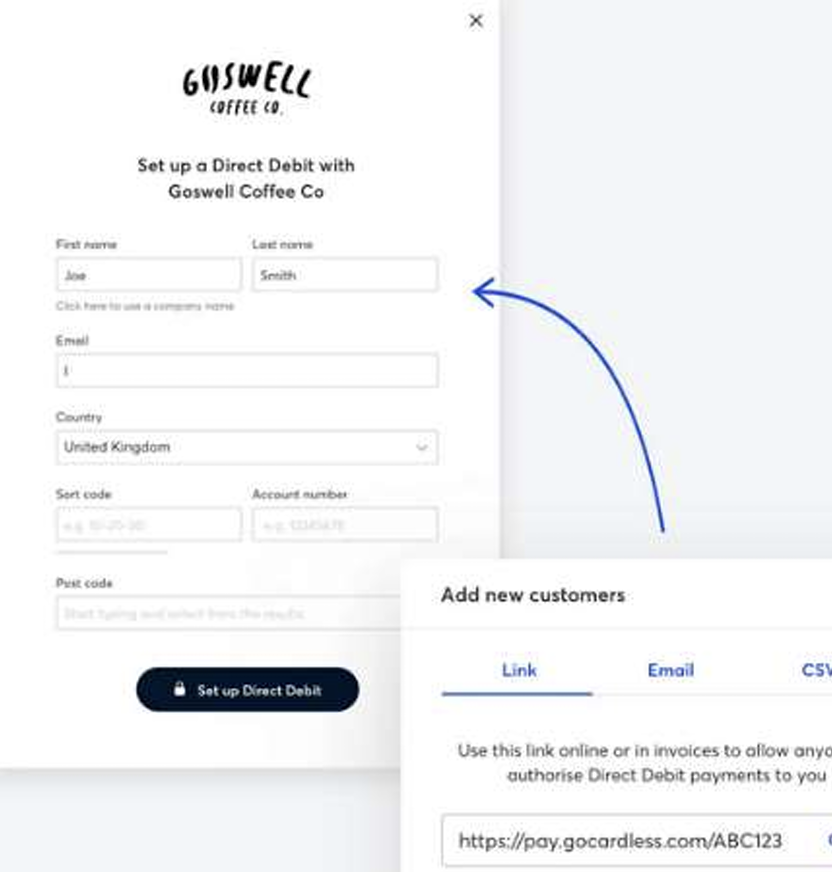

The GoCardless platform allows small businesses to easily accept payments from their Customers automatically using Direct Debit. It works for regular and ‘one off’ payments, as well as obtaining payment of invoices in instalments.

1. Enable annual fees to be paid across an agreed period (Subscriptions)

2. Add a ‘Pay Now’ button to all of your ‘one off’ invoices to Customers to encourage ‘faster’ payment (Instant Bank Pay)

3. Enable regular invoices for Customers to be paid on an agreed ‘Due date’ – Automatically!

(Recurring Payments) GOCardless allows you to agree and set the Direct debit payment date with your Customers – and hence enables better control of your monthly cashflow!

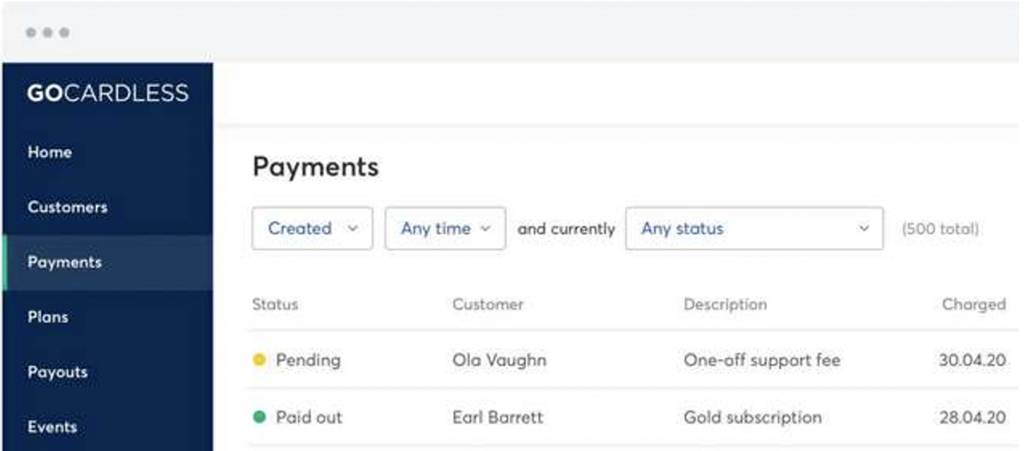

How do I use it within Xero or Quickbooks?

Both Xero and Quickbooks are ‘Partner Integrations’ with GoCardless which means that that where there are agreements (mandates) in place with Customers, the platform ‘links’ directly with the accountancy software allowing for –

– Invoices raised in Xero or Quickbooks on a recurring basis to be ‘automatically’ paid using GOCardless on a ‘due date’

– Buttons or ‘links’ to be added to ad hoc or other invoices for Customers to pay immediately

– GOcardless payment information, fees and charges for Customers to be ‘automatically’ updated in the accountancy software

GETTING MORE FROM XERO/QUICKBOOKS – USING GOCARDLESS

Why should I use it in my business?

Save time – reduce your ‘credit control’ efforts by ensuring invoices are paid on time or on an agreed instalment basis! Additionally, reduce your ‘day-to-day’ bookkeeping time by ‘linking’ Xero or Quickbooks with GOCardless to ‘auto reconcile’ paid invoices – freeing up your time to focus on more important things.

Improve Cashflow – dramatically improve your monthly cashflow by enabling invoices to be paid ON the ‘due date’, ‘speeding up’ payment of ‘one-off’ invoices with ‘Pay Now’ buttons and reducing your own time and effort around managing cashflow

Additional costs – The costs of using GOCardless are lower than Stripe, Paypal or other similar payment providers!

Do I need to set it up in Xero or Quickbooks?

YES – there are specific settings and other processes that need to be set up and configured to enable the benefits of the ‘automation’ to work effectively in the accountancy software – depending on the product being used with Customers!

Is there any additional cost or is it included in my current software subscription?

NO – there are no additional costs of using GOCardless with Xero or Quickbooks, and just a ‘per transaction’ cost in respect of the payments taken – similar to Stripe, Paypal etc

Can the Sakura Team assist with this?

Yes – If you are on our annual Support service, then just arrange a call with the team, and we can explain how GOCardless may work with your business – and deal with the setup and configuration requirements where necessary!

Alternatively, we can provide some additional information and/or How To Guides.