Getting more from quickbooks… bank rules!

November 23, 2023

Continuing our series of highlighting some interesting or actually quite important features in Quickbooks or Xero, we now highlight the use of ‘Bank Rules’ in Quickbooks.

Looking to speed up or save time with your bank reconciliation work each week or month – then look no further than using ‘Bank Rules’!

Find out more below!

What do Bank Rules do?

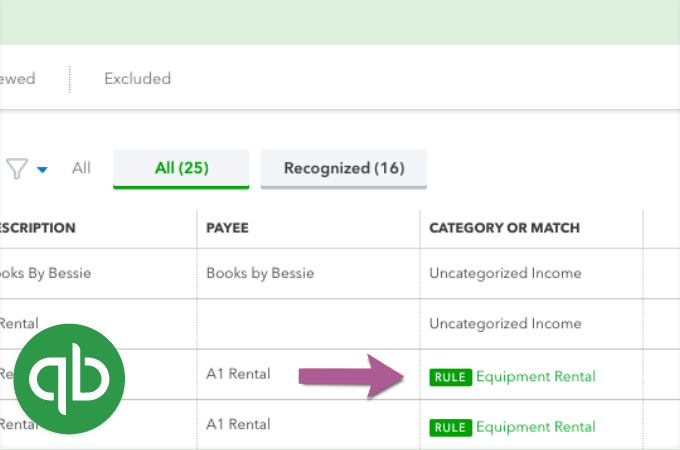

The use of ‘Bank rules’ in Quickbooks speeds up the reconciliation of frequently recurring bank statement lines – avoiding the need to ‘Categorise’ these transactions manually as you reconcile your bank account(s) each day, week or month!

Once a ‘Bank Rule’ has been setup, it simplifies the reconciliation process by suggesting a matching transaction based on the conditions that have originally been set on that specific ‘Bank Rule’.

How do I use them within Quickbooks?

Typically, a number of quite specific ‘Bank Rules’ are created to manage your frequently occurring bank transactions (non invoice bank transactions), such as the following:

- Travel costs e.g. TFL, London underground, Uber etc

- Parking costs e.g. Ringo

- Café costs e.g. Caffe Nero, Costa Coffee

- Salary payments

- Dividend payments

- Bank charges

- HMRC payments (and references)

There are different types of ‘Bank Rule’ depending on the type of bank transaction involved such as a ‘Money Out’ rule or a ‘Money In’.

Getting more from Quickbooks, using Bank Rules.

When should I use Bank Rules in my business?

Save time – anything that ‘speeds up’ and improves the accuracy of the bank reconciliation(s) for your business is only a positive outcome. As the use of ‘Bank Rules’ also reduces the amount of manual time and effort involved which is also a significant benefit.

Accurate data – data is much more accurate as the creation of ‘conditions’ in each ‘Bank Rule’ ensures that the correct.

Up to Date financials – more regular (and accurate) bank reconciliations in Quickbooks, mean more accurate and more up to date financial information e.g. current cash position, Customer invoices outstanding etc.

Do I need to set them up in Quickbooks?

Yes – each specific ‘Bank Rule’ requires to be setup with the various ‘conditions’ necessary to automatically identify the bank transaction e.g. transaction description(s), bank account(s), account code (cost line) allocation etc.

Is there any additional cost or is it included in my current subscription?

No – the ‘Bank Rule’ feature come as part of the core Quickbooks subscriptions.

Can the Sakura Team assist with this?

Yes – if you are on our Quickbooks Support service, then arrange a call with Nasima who will make the adjustments in your software for you.

Otherwise – we have some Quickbooks How To Guides that may assist you to set up yourself in Quickbooks.