Why xero remains top of the class for sme businesses (and why we still like it)

Here at Sakura, we sometimes get asked why we use Xero (and QuickBooks – yet that’s a different blog), and not some of the other finance software out there.

READ MORE

6 ways an accountant helps your business – more than a coach

In today’s fast-paced business world, accountants are doing much more than balancing books—there are commercially experienced strategic partners who can drive growth and improve efficiency

READ MORE

Cash flow vs. profit: why both matter for your business

When it comes to measuring the health of your business, two financial numbers take centre stage: cash flow and profit. We aim to identify the differences between cash flow and profit

READ MORE

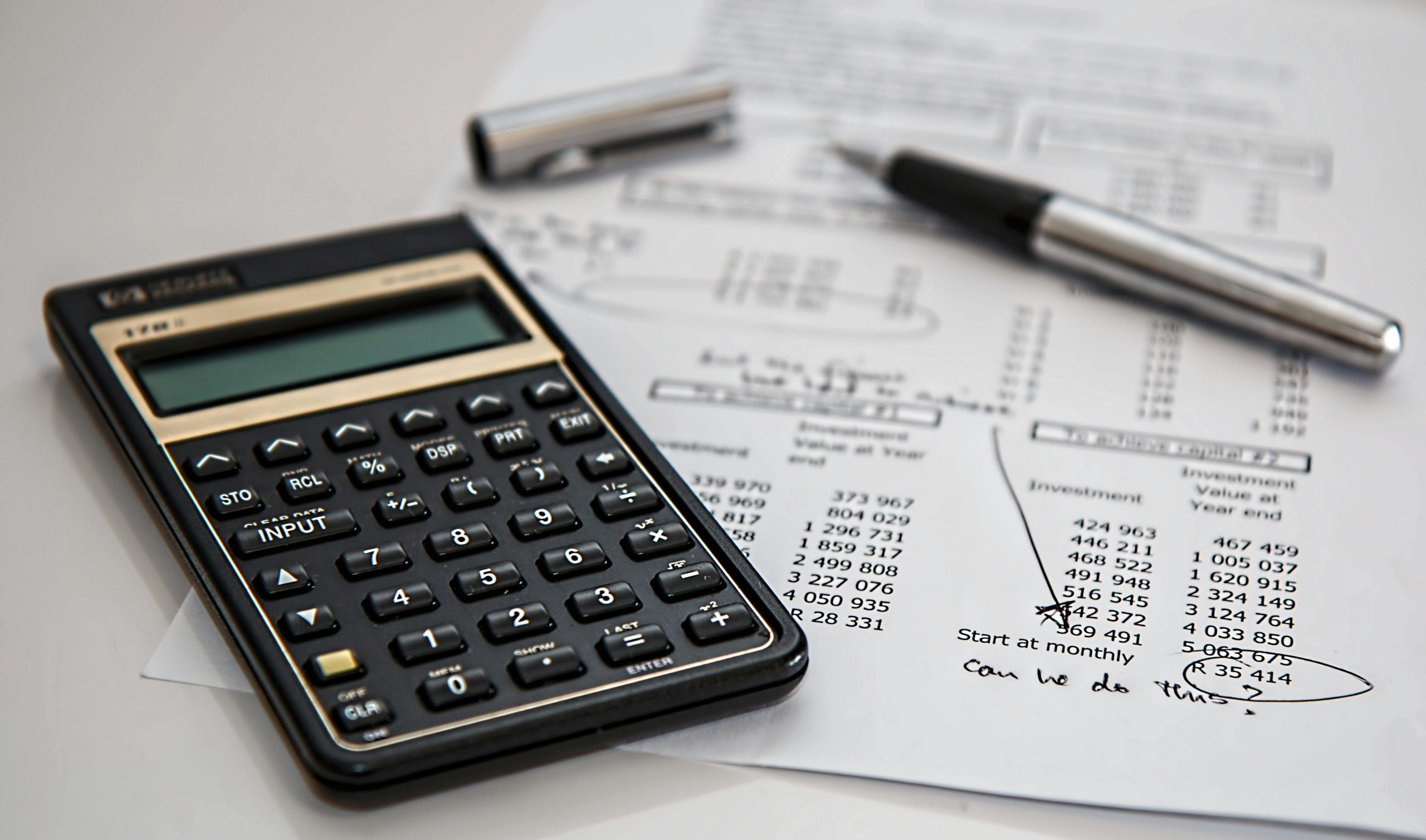

How to read a profit and loss statement: a complete beginner’s guide

Understanding your business’s financial performance enables you to make the RIGHT decisions on your business, and the Profit and Loss (P&L) is a core part of any limited company’s accounts!

READ MORE

How to read your company’s balance sheet – a complete beginner’s guide

Although often delegated to the Accountant, increasingly we are of the view that it is absolutely key for SME business owners to understand the basics of a Balance Sheet!

READ MORE

6 ways an accountant helps your business – more than a coach

When you think of an accountant, you might picture someone crunching numbers or filing taxes...

READ MORE

How to manage risks and build resilience into your business

In today’s unpredictable world, risk and resilience aren’t just buzzword — they are KEY to a business! We take a look at how to manage risks and build resilience into your business.

READ MORE

4 reasons why your business may struggle to obtain third party finance

Many business owners find themselves facing rejection when applying for overdrafts or business loans. Understanding the common reasons behind finance or loan denials can help you better prepare.

READ MORE